If we look into history of different countries we will find that different countries faced the financial crises at different times. As the world is facing now financial crisis now also, the question comes in mind that who are those who run this finance horse, what are the reasons which leads to financial crises? Or is there is someone who is holding all the strings and keep them pulling? So many questions come in mind when mind starts thinking about it.

Well I had searched about this and compiled these ten nasty crises. Check out these ten dramatic crises.

1 – Argentine economic crisis (1999 – 2002)

Argentinean economy was destabilized in 1980s when Latin American Crisis struck it. Argentine was an import dependent country where people usually convert their peso into dollars to feel secure. The high inflation rate leads its currency to lose the confidence and adding oil to fire the government that time spent generously on itself while ignoring the country’s crumbling industrial infrastructure.

Mexico and Brazil were the major trade partners of the Argentine in 1980s both countries suffered the economic crises which spread out in Latin America. Brazil’s currency was devalued in 1999 that damaged a lot Argentinean exports and adding fuel to fire the dollar was revalued giving a harsh blow to Argentinean Peso.

Till 1999 the country was having 3rd consistent year of economic decline but the government haven’t devalued the peso, which made the crisis worse. In such conditions the investors ran on banks for dollars to send abroad for safety. Meanwhile the government freezes everyone’s bank accounts. This step of the government raised violence amongst citizens and protests through out country were started. The government was collapsed in 2001. While in crisis the people were bartering for goods because lack of cash, many people eked out a living by scavenging cardboard for recycling plants.

The new government 1st tried to setup a third currency between dollar and peso but that failed. Then it instructed the banks to convert all dollars into pesos. That step worked and peso was lead to diminish in value. Because of that exports got higher and in meanwhile the government tightened its tax policies, improves social welfare, encourages business growth and put the reserve dollars up for sale in market. The country got the surplus trade because of its agricultural products anyhow its still struggling with inflation.

Lesson

Freezing bank accounts leads the crises to get worst. It can’t be a smart step to tackle the crisis.

2 – Russian Financial Crisis (1998)

The Russian government in 1993 introduced inflation-free short-term treasury bills known as GKOs to finance the country’s deficit. GKOs were traded on currency exchanges. Most of it was state owning while only 1/3 of funding came from foreign speculators who were attracted by high interest rates. Like a classic Ponzi scheme the government used proceeds from sales of new GKOs to payoff interest on matured bills.

To raise the capital the government increased GKOs interest rates up to 150% in June 1997. GKO interest payments included more than half of the federal government’s revenue by beginning of 1998, which made them large source of revenue.

In meantime the government was having due wages about $ 12.5 billion to its workers and on other side they were getting more money from GKOs than from taxes. Investors lost confidence in the Russian government when they looked on the financial facts and in result they started selling Russian securities and rubles. To stabilize the ruble the Central Bank spent almost $27 billion of its United States dollar reserves but that haven’t succeeded.

The Russian market was collapsed in 1998. Investors were afraid about the devaluation of the ruble and a debt default that caused the market to drop down 65% in one day. In result the major banks were closed and inflation rate got high. It also eradicated the nascent middle class by eating through people’s bank savings.

The government reduced its funds for social and municipal services and luckily after 1999 the oil prices got high which help a lot for a quick recovery.

Lesson

Ponzi scheme always ends up being much more expensive on long run.

3 – Asian Financial Crisis (1997 – 1999)

South East Asia was a hot international investment destination during 1997-1999. The high short-term interest rates of ASEAN countries given foreign investors favorable rates that made the fluent capital flow of in the region.

In the early 1990sthe growth rates were so high as 12% of GDP, and assets prices were increased also, leading analysts refers it as a remarkable thing as “Asian Tigers” and “Asian Economic Miracle”.

In meantime Thailand, South Korea and Indonesia were having huge deficits for that these countries borrowed quite a bit of money externally keeping their own interest rates fixed which at end lead them to damage in foreign markets.

In early 1990s foreign investors turned out from Asia as higher U.S, interest rates made dollar value high, this affected South East Asia’s exports as their currencies were pegged with the U.S. dollar, so in result they lost their exports competitiveness. By the beginning of 1996 South East Asian exports were slowed down, at least it was fueled by China’s increased competitiveness in the export market.

What were the causes of that crisis? Some say that it was because of the policies leading to large amounts of credit pushing up asset prices which collapsed then which lead to a massive debt defaults (kind of like the sub prime crisis).

The foreign investors got the infectious fear so they pulled out their investments. To hold the region attractive for foreign investors ASEAN governments pulled up their interest rates and bought up excess domestic money using foreign reserves. Which lead the government’s central banks run short of foreign reserves and on other hand capital was still flying out from the region.

Thailand’s government floated the bath in 1997 to engage the Asian Financial Crisis. Regional currencies depreciated making liabilities in terms of foreign currency more expensive in domestic terms. It melted down the whole economic sectors and people felt into poverty. Stock markets crashed down and currencies devalued. That led to the political destabilization with so many executive resignations and increase in extremist groups.

The International Monetary Fund made bailout packages stating removal of faults in exchange for debt defaults. In these reforms government expenses were cut down, allowing banks to fail, raising interest rates and becoming more transparent.

So far the results of the IMF’s actions are doubtful for reaction against powerful international NGOs that continues today. According to some analysts Asian crisis had also contributed to the recent United States housing bubble.

Lesson

In crisis if rich people interfere offering their money in exchange for an agenda that not for sure always their agenda will work or will be having any useful results. Financial meltdowns can happen with blink of an eye.

4 – The dot-com bubble (1995 – 2000)

A new type business came out into view in the mid-1990s, The .com, a company based on the Web or servicing the internet, its people and its technology. In beginning when dot com stock values shot skyward venture capitalists started all together to finance Internet startups.

As there was no certain business plan of dot com that can stop many VCs from investing in it. While investors and startup executives thought that the .com would gain the attention of people they will get back the reward for their investments.

Speculators crawled in making a market full of wildly overvalued startups, spending so much on gigantic publicity campaigns followed. dot com burned through their VC money with hope that it will come back soon. Day trading became relatively common way to make fast money.

Though the government hasn’t paid attention to .com startups or speculation, its policies and timing mightily contributed to a loss of confidence. Between 1999-2000 interest rates were raise six times to prevail the economy and in meantime a flurry of government investigations stalled corrupt business practices.

For example as the NASDAQ began its slide, Microsoft was declared a monopoly. Main telecommunication companies like MCI Worldcom was fall in heavy debt and management scandals. Regulators put the financial industry under fire for misleading investors during the .com boom and famous Enron was collapsed when the investigators found out an accounting scandal.

In 2002 the Sarbanes-Oxely Act was passed out having unyielding transparency and accountability standards for public companies.

Lesson

The market always welcomes new technology but on long run it become harsh giving you a hard blow of losing assets.

5 – The Japanese asset price bubble (1986-1990)

Japan’s domestic policies after World War II urged people to save money. People deposited more of their savings into banks, which made it easier for companies to take out loans and lines of credit.

By using their lines of credit Japanese companies invested in capital resources, which made them capable of making more goods than international competitors. Japan had provided high quality products on reasonable prices and its products high demands in world lead it to become a major economic power in world.

The yen was appreciated and investors made good money off financial markets. Majority of people used easy credit to make property and homes making a speculative real estate bubble. Because of that the real estate prices gone skyward as 1 square foot rate of property in Tokyo was selling at $139,000. Stocks prices were having no limits in rising up, because of reinvestment the economy expanded more. In December 1989 the Nikkei reached all time high of 38,957.44. But in early 1990s Japan’s bubble started to sink. But that haven’t happened in flash of time that happened slowly, stock and real estate values decreased heading to Japan’s “lost decade”. People pulled out their investments and started investing out of Japan because of that Japanese companies lost some advantages of their competitiveness internationally. Low consumption rates coupled with lower output and employment meant steady deflation.

Though the government lower the interest rates to practically nothing that haven’t encourage Japanese people to put money in the banks. The government subsidized banks and businesses at extreme end of failure, supporting up the zombie organizations with little visible benefit to the economy. Finally in 2003 the Nikkei started to climb again.

Lesson

Surely bubbles look wonderful while growing but when they sink, as they have to sink they pulls back the economy more than a decade.

6 – Wall Street Crash of 1929

Hundreds of thousands investors contributed to a speculative bubble in the stock market in the late of 1920s. So many taken debts to purchase stock and in result more than $8.5 billion in debt throughout the nation and that was a lot bigger amount than circulation amount at that time.

The market turned bearish on October 24, 1929 making investors panicked that caused a massive sell off that tanked the stock markets and that also played major role to the Great Depression of the 1930s.

To encourage people and gain back their confidence the Rockefeller family and the heads of major banks bought large quantities of stock but this move haven’t worked. So in result during week the week of October 24, the market lost $30 billion, which was more than the amount, which United States had spent on World War I. That stock market crash caused businesses closed, massive layoffs and immense bankruptcies. An international run on dollar resulted in increased interest rates, driving out around 4,000 lenders.

Congress passed the Glass-Steagall Act of 1933 after an investigation that mandated a separation between investment and commercial banks with believe that it would prevent another dramatic panic sale. It didn’t the Dow fell 22.6% in 1987 but to date the Great Depression that followed the 1929 crash hasn’t been repeated.

Lesson

According to many scholars 1929 crash didn’t cause the Great Depression but certainly contributed to make it more severe and public panic only made the situation worst more.

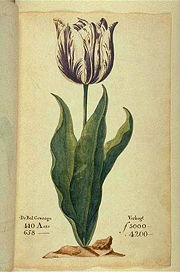

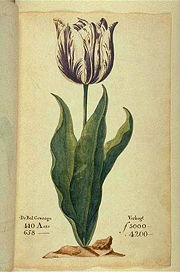

7 – Tulip Mania (The Netherlands, 1637)

The 1st speculative bubble that is not about property or companies that’s about tulip bulbs. Turkey to Europe introduced tulips in the mid-1500s; people in the Netherlands grew especially fond of them seeing them as status symbol.

A certain virus, which develops amazing colors, flames and lines on their petals. Virus infected tulips got so many varieties and those were given beautiful names and were greatly desired by the population. Tulip with the virus takes 12 years to grow from seed to flower so in order to save these extravagant tulips a market developed around their trade.

To have guarantee of having tulips at the end of season traders signed medieval futures contracts. On other hand professional growers were willing to pay more and more for popular flowers. There were some kinds of tulips that were having more price than people’s annual income.

In 1630s speculators, lured by tales of sudden riches, flooded the market. The Dutch government banned short selling future contracts so many times in 1600s to control the obsession and also created a formal market for purchasing and selling of tulip futures for that traders have to pay a little fee for each trade.

Bulb prices kept on increasing until 1637 and tulip traders then were no longer able to sell bulbs at inflated prices because of that demand fallen down that made price to decline. The tulip futures trade stopped.

Tulip investors gone for help to the government and government declared future contracts invalid with a 10% fee. Many future holders voided their contracts and bulb sellers were stuck with their inventory.

Lesson

Not even in case of tulip bulb future but also in other cases when people are convinced that they can become rich quickly they often lose their minds.

8 – Northern Rock Bailout (Great Britain, 2007)

Martin Upton Financial services expert describes that when the vast numbers of mortgage holders with bad credit in the United States defaulted on their loans, financial institutions around the world became cautious about lending one another money. Anyhow no one was sure how much money their exposure to the US sub prime crisis would lose them.

So it resulted crawling down liquidity around the world and interest rates climbing up. The Bank of England hasn’t flooded the markets with billions of dollars unlike the United States. For the most part banks were depending on themselves.

Northern Rock’s profitable mortgage business (consist of 40% company’s assets), was located in a company in the Channel Islands called Granite.

Granite a charitable trust that was set up to benefit a Down’s Syndrome charity. Though it never donated anything from its 45 billions pounds assets for charity while it was acting as a securitization vehicle selling assets-backed securities to investors and replacing mortgages with new ones.

It was hard for Northern Rock to cover its money market borrowings when global liquidity dried up so it asked the Bank of England for money in 2007 and then it was given emergency financial support by Tripartite Authority.

When the news came out the customers started withdrawing their money quickly and almost 1 billion pounds that is 5% of Northern Rock’s total bank deposits were withdrawn in one day and 2 billion pounds more by September 17 which the bank shares fell down 72%.

It was slowed down after the announcement by the British Government that it would guarantee all Northern Rock deposits. Northern Rock sold out its lifetime home equity release mortgage portfolio to JP Morgan in January 2008; it gained 2.2 billion pounds from that which it paid off part of its Bank of England loan.

In February it was nationalized when government announced about adding Northern Rock’s liabilities to the country’s national debt, now holding at 45% of GDP.

The report about Northern Rock crisis released in March 2008 shown weak government supervision during its crisis but mainly its senior management was blamed for the collapse.

Lesson

A business can never survive by repacking debt as assets in a fake nonprofit. That only works when economy is going smoothly.

9 – United States Savings and Loan Crisis (1980s-1990s)

As described by a policy expert Bert Ely the causes behind this mess were old and incompetent policies. Its cost was estimated $160.1 billion from which $124.6 billion was taxpayer money and 747 United states savings and loan associations.

The government picked S&L’s that was funded by short-term deposits to finance long term for fixed rate mortgages. Whenever short-term interest rates get high, S&Ls lose money on their long-term mortgages making negative affect to mortgage interest rates.

The S&L industry regulated a Depression area limiting the interest rates that banks can pay to their deposits to keep interest costs under control, S&L used funds from savers to cover home buyers and earning interest income on ten to twenty year old fixed rate mortgages, Ely calls that “maturity mismatching”.

S&L rates were gone below market value because of restrictions on interest rates. While Fannie Mae and Freddie Mac kept interest rates low for home buyers, S&Ls profit limited and aside from that there was another reason also that they relied heavily on maturity mismatching to make a profit.

The S&L industry collapsed because the interest rates were gone so high when the Chairman of the Fed Paul Volcker restricted the dollar growth in the early ‘80s to tackle stagflation.

Fannie Mae and Freddie Mac were given responsibility to support mortgages for needy families. The Financial Institutions Reform, recovery and Enforcement Act (1989) forming two new supervision agencies, a new insurance fund for thrifts and trust corporation to get rid of the zombie institutions that are taken over by regulators.

Lesson

Unessential restrictions implemented by government on bank’s ability to make money that makes banks to work around to keep their bottom line working. And when any change is made in government policy that blows the lid off the bank’s work around and the whole system collapses.

10 – Swedish Financial Crisis (1990-1994)

Sweden removed the regulations from its credit market making way to a commercial property speculation bubble. This hope for having more profits were burst between 1990-94 giving heavy losses to 90% of the banking sector which includes all major banks of Sweden.

The government bailed out the banks and nationalized two of them, which were looking to survive the crisis. It also extended a guarantee to those bank’s creditors, which kept consumer confidence up. That let the banks financially ruined by the crisis fail. Eventually the government took on bad assets worth about $9.9 billion, it recovered the losses through dividends and reselling assets from the nationalized banks. Stockholders were left empty handed, but taxpayers didn’t have to foot the bailout bill.

Lesson

The investors who invest in the stock markets are able to bear the losses. Taxpayers can’t be punished for someone else’s oversights. Its better to save taxpayers rather than stockholders.