What this indicates is that the cost of borrowing money on credit cards is going to continue to increase. It’s also clear that if you want a FRESH START that you need to visit www.joetufo.com/debt and learn how to resolve your debts for 40 cents on the dollar, GUARANTEED!

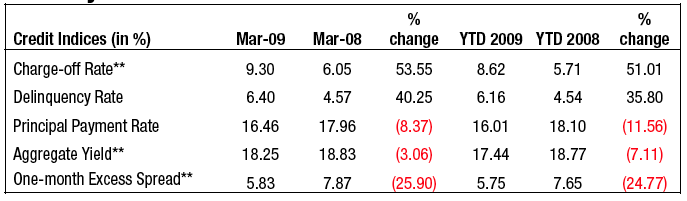

The Moody’s Credit Card Index charge-off rate continued to climb in March to a record high 9.30%. The delinquency rate, which usually falls this time of year due to tax refunds, continued to climb month-over-month and reached a record high as more and more borrowers fall behind on their credit card debt, Moody’s said. The charge-off rate measures credit card balances written off as uncollectible as an annualized percent of loans outstanding.

Given the pace of this deterioration, we expect the charge-off rate index to peak in the second quarter of 2010 at about 12% (revised from 10.5%).

“Other performance metrics improved in March. The yield index increased for the third consecutive month in March to 18.25%, aided in large part by card companies’ proactive measures to bolster the yield of their respective trusts. Also, as expected, the payment rate index bounced back from last month’s low rate to 16.46% in March. This improvement was mostly attributable to the technical issues related to the number of collection days in the relatively short month of February rather than any fundamental improvement in obligatory payment behavior.”

Details are available here.